Business Case – Sector Overview

| Sector | Why a battery? | |

|---|---|---|

| Industrial & logistics | Reduce peak demand charges, stabilise production loads and generate revenue from balancing markets. | |

| Agriculture | Store solar or biogas energy, meet seasonal peaks (milking, cooling fruit), benefit from VLIF subsidies and peak shaving. | |

| Retail & hospitality | Increase self-consumption, protect against outages, support EV charging for customers. | |

| Data centres & technology | Provide UPS backup, integrate with solar/wind generation and participate in balancing markets. | |

| EV & fleets | Buffer energy for fast-charging without oversizing grid connection; trade energy during idle periods. |

Why a Battery?

How can it save & earn money?

A modern battery behind the meter solves multiple real-world challenges — and creates new revenue streams for your company.

Key challenges solved by a battery

Renewables are intermittent

A battery stores energy when it’s available, so you can use it later.Energy prices change

Charge during low tariff, use when peak tariffs apply.Demand spikes

Smoothes power peaks to reduce charges.What does a battery actually do for your company?

Behind the meter, a battery provides three revenue streams at the same time:

Peak shaving – reduce grid tariffs

- Grid tariffs depend on your highest monthly peak.

- A battery discharges during peak moments so your peak becomes lower.

- Result: lower capacity charges every month.

In 2025 this matters even more — tariffs will penalise high peaks harder.

Use more of your own solar power

- Extra solar is stored instead of being injected for nothing.

- You later use that energy instead of expensive grid electricity.

- Result: higher self-consumption, lower energy bill.

Income from balancing markets

- Your battery stabilises the grid by reacting in milliseconds.

- Certified EMS partners automate everything.

- You earn:

- a fixed annual availability fee

- a fee for every activated MWh

The combination of peak shaving + solar optimisation + balancing income creates a strong business case.

What does a system cost?

Typical industrial battery (installed, 2025):

Depending on:

- power (kW)

- storage duration (kWh)

- inverter type

- site-specific works

Ideal for:

- peak shaving

- solar shifting

- balancing income

Typical for industrial setups – exact pricing depends on project specifications and feasibility analysis.

Financial & government support

These financial advantages from the Belgian and Flemish governments can significantly improve your payback time.

- deduct 40% of the investment amount extra from taxable profit

- battery becomes up to 140% tax-deductible, reducing corporate tax

- guided & subsidised trajectories

- investment and financing advantages

- support to structure your project

- for large or innovative storage projects

- minimum investment: ~€1.5 million

- support: 20–55% of ecological surplus cost

- maximum: €500,000 every 3 years

- VLAIO finances 85% of feasibility study

- company pays only 15%

- ideal as pre-study to check eligibility for 40% deduction

Is it realistic?

- Payback under 10 years is realistic

- Faster with balancing income

- Even faster when combining subsidies & investment deduction

Conclusion

In 2025, an industrial battery in Flanders is often a profitable and strategic investment. With proper dimensioning and the right mix of financial & government support, it becomes a financial asset that:- lowers energy costs

- increases independence

- boosts sustainability

- avoids grid upgrades

- creates new revenue streams

📞 Want your personal payback calculation?

Contact us for a personal calculation and business case for your company — or request a price indication for an industrial battery on your site. We analyse your consumption, peaks, solar production and tariff region, and provide a clear, data-based financial plan for your project.

Tailored Agricultural Package

Meet our unique Flemish-market tailored battery solution!

Buy an 80 kWh battery for 22.000 EUR* and

get 18.096 EUR back from VLIF!

Meet our unique Flemish-market tailored battery solution!

Buy an 80 kWh battery for 22.000 EUR* and

get 18.096 EUR back from VLIF!

*Price depends on installation specifics (existing board, no extra trenching/drilling, placement accessibility, etc.)

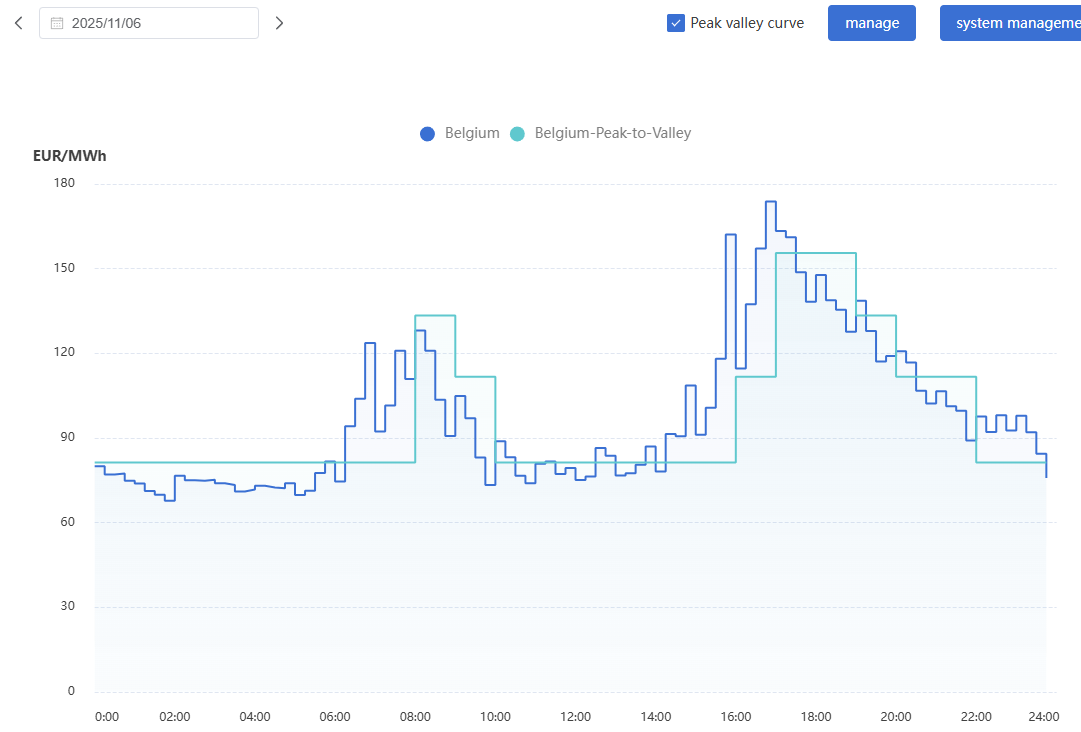

Energy Pricing Trend Impact on ROI

As electricity prices vary throughout the day, battery systems can store energy when cheaper and use or sell it when prices peak — improving your return on investment.

The greater the price difference between low and peak hours, the higher the potential financial benefit from a battery system.